Why I splurge in Europe: How to claim your VAT back

Unlike the U.S., in Europe, the price you see is the price you pay. There are no additional taxes, fees, tips, or anything (MOST places). Just one price. Being that non- European passport holders are tourists just visiting and do not live there we get to receive the taxes back after spending a specific minimum amount in certain places. Different countries have different minimum spending and different tax back percentages. Kind of like how different states in America have different tax percentages. I will share ways to find out about countries’ tax at the end.

I save up all year and mostly purchase my designer items in Europe because in addition to them already being less expensive I also get VAT tax back on top of that, making savings to about 30%. This applies to most big European brands. Interacting and chatting with sales assistants I learned that since these brands are made in Europe the retail prices can stay low in Europe. When these items go to foreign countries they have to pay import fees resulting in higher prices. You do not get VAT back on everything, please do not go into a restaurant or other shops demanding your tax back saying Abbey sent you lol. Shops usually advertise with a sign outside, but you should definitely inquire with stores if you are eligible especially if you are spending a great amount.

Before I get to Europe I already price items and calculate the savings. I check the designer European website to see how much less it goes for after conversion. To find out how much money I would get back I use the Global Blue app. You can just select your country and type in the amount the item is and it will calculate your total refund. I like to purchase items that I can’t find in the U.S., items I can't get with my friend’s & family's employee discount lol, and discounts in general like going on sale. For example, Louis Vuitton does not offer discounts or sales ever. Sure employees have some perks but I’m not an employee. Certain items like a Chanel Classic flap quilted bag in a classic color are usually NEVER eligible for discounts. Being that it is not easy to save on these kinds of items at home, these are the items I buy overseas.

Here's a case study

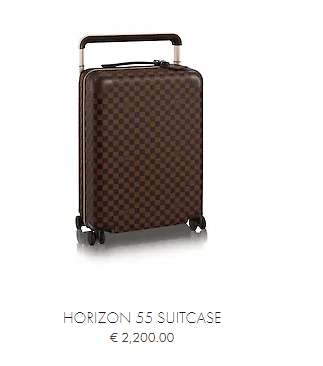

This Louis Vuitton bag is

$3,2500.00 + (NY tax) $288.44

= $3,538.44

2,200 - (Spain tax back) 319 =

1,881 x (today’s exchange rate) 1.15 = $2,163.15

Savings of $1,375.29

CLaiming Your Tax Back

This can get tricky especially if you are unaware and going to other locations in Europe. I will explain how to receive your tax back if you made purchase in an European Union:

**Update: In my recent travels to Madrid, Spain and Lisbon, Portugal, I only had to scan my tax-free form and that’s it! No receiving stamp, no mailing necessary. This might not be the case for every airport.

1. Every Country in Europe isn't a European Union

You may think since the country is in Europe then it is a European Union, WRONG! My silly self thought that too until I tried to claim my tax back leaving Switzerland! Which is NOT a European Union. So I was not able to claim for tax back and I was PISSED! Luckily I returned to Europe before my eligible time frame was up (3 months from the date of purchase) and was able to claim my money. Don't be a victim like me!

2. Departing Your Last EU

The tax back is for visitors so you have to be leaving your last European Union country. So if you are going from Paris to Amsterdam you can not claim your money until you are going to a non-European Union like Switzerland. When checking in with customs they will ask for your passport and boarding pass and sometimes the item. So keep the item(s) in your carry in case they ask.

3. 3 Month Time Frame

Like I stated previously, I wasn't able to claim my tax back during one of my trips but I was able to claim it when I returned to Europe. You are given until the last day of the third month that it is on your form. If you purchased something on June 25th, you have until September 31 to claim your tax back.

4. Cash or Back on your card

You have the option of getting the money back in cash (the country currency most of the time) or back on your card if you paid with one. Sometimes with cash, they may take a little for a "processing fee" and sometimes they don't. Since I am usually leaving I just put the money back on my card so I don't have euros that I won’t be using, however, this can take 2-8 weeks to show up on your statement.

5. Retrieve your stamp

At your departure location, find the customs office. This can be a hassle in a big airport so try to research exactly what part of the airport it is located first, and get there early to make your life easier. They will review your tax-free paper(s), passport, and boarding pass. They will stamp the form, then you simply put everything in the envelope provided and put it in the nearby tax-free mailbox.

Some airports have kiosks which I love! The line is never long and you simply scan the barcode on your form, put everything in the mailbox next to the machine, and wait for your refund. Sometimes you don’t even have to mail anything in, you just scan and go. This is if you do not want cashback. Claiming your tax back is pretty simple once you understand what you are doing.

(For those departing by train please see my additional links below for more information).

EU nations

There are 50 countries in Europe and 28 of them are member of the European Union

Austria (1995)

Belgium (1958)

Bulgaria (2007)

Croatia (2013)

Cyprus (2004)

Czech Republic (2004)

Denmark (1973)

Estonia (2004)

Finland (1995)

France (1958)

Germany (1958)

Greece (1981)

Hungary (2004)

Ireland (1973)

Latvia (2004)

Lithuania (2004)

Luxembourg (1958)

Malta (2004

Netherlands (1958)

Poland (2004)

Portugal (1986)

Romania (2007)

Slovakia (2004)

Slovenia (2004)

Spain (1986)

Sweden (1995)

United Kingdom (1973) – (Leaving on March 29, 2019)